Personal financial management

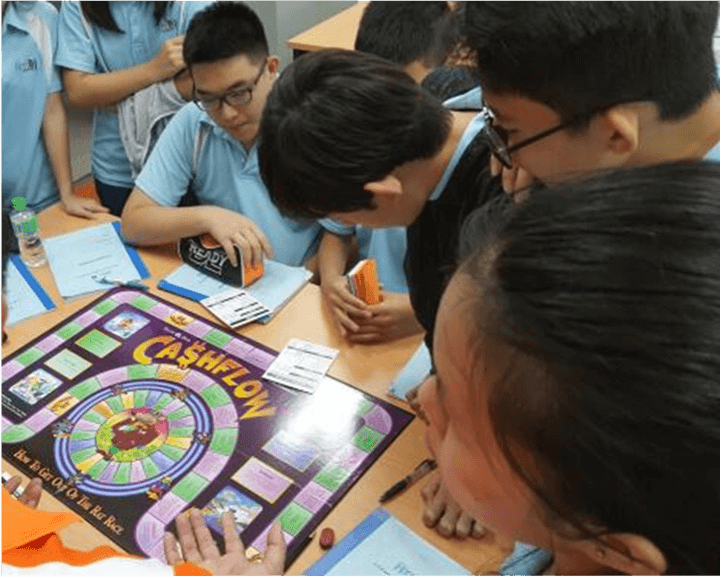

Analyse alternatives

Buying Real Assets

Do your homework – due diligence

Banking & Economics 101

Entrepreneur-based project learning

Study failures

Giving back mind-set

Basics of investing.

The difference between assets and liabilities.

The importance of understanding a financial statement.

Basic personal accounting.

International Primary & Secondary

国际小学与中学教育

© 2016 – 2025 Axcel International School. All Rights Reserved.